In the ever-evolving world of cryptocurrency, understanding the best way to purchase bitcoins is crucial. This comprehensive guide delves into the intricacies of bitcoin acquisition, empowering you with the knowledge to make informed decisions and navigate the cryptocurrency market with confidence.

From exploring the different types of cryptocurrency exchanges and payment methods to delving into security considerations and market analysis, this guide covers all the essential aspects of bitcoin purchasing. Whether you’re a seasoned investor or a curious novice, this guide will provide you with the insights and strategies you need to make the most of your bitcoin investments.

Exchange Platforms: Best Way To Purchase Bitcoins

Cryptocurrency exchanges are platforms that facilitate the trading of cryptocurrencies. There are three main types of exchanges: centralized, decentralized, and peer-to-peer.

Centralized exchanges are operated by a single company that controls all aspects of the exchange, including the matching of buy and sell orders, the setting of prices, and the custody of user funds. Decentralized exchanges are operated by a network of computers, and users trade directly with each other without the need for a middleman.

Peer-to-peer exchanges are similar to decentralized exchanges, but they are typically less regulated and may offer more flexibility in terms of payment methods.

Fees

The fees charged by cryptocurrency exchanges vary depending on the type of exchange, the payment method used, and the amount of cryptocurrency being traded. Centralized exchanges typically charge higher fees than decentralized and peer-to-peer exchanges, but they also offer a wider range of features and services.

Security

The security of cryptocurrency exchanges is a major concern for investors. Centralized exchanges are generally considered to be more secure than decentralized and peer-to-peer exchanges, as they have more resources to invest in security measures. However, even centralized exchanges have been hacked in the past, and there is always the risk of losing funds due to a security breach.

Supported Payment Methods

The payment methods supported by cryptocurrency exchanges vary depending on the exchange. Centralized exchanges typically support a wider range of payment methods than decentralized and peer-to-peer exchanges. However, some decentralized and peer-to-peer exchanges offer support for alternative payment methods, such as gift cards and mobile payments.

Advantages and Disadvantages

Each type of cryptocurrency exchange has its own advantages and disadvantages. Centralized exchanges are typically more user-friendly and offer a wider range of features and services. However, they also charge higher fees and are more susceptible to security breaches. Decentralized and peer-to-peer exchanges are typically less user-friendly and offer a more limited range of features and services.

However, they also charge lower fees and are less susceptible to security breaches.

Payment Methods

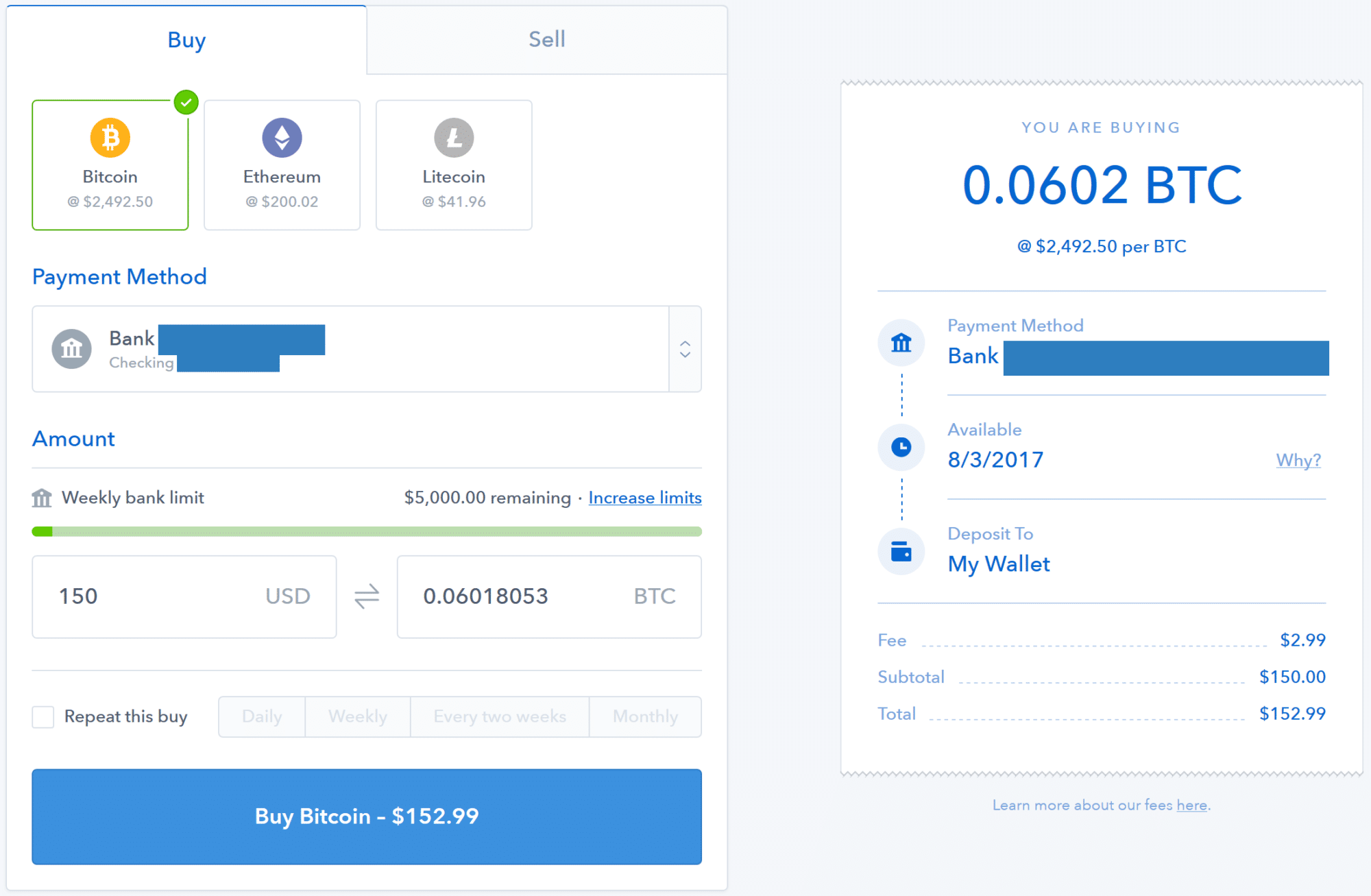

Cryptocurrency exchanges provide various payment methods to cater to the diverse needs of their users. The choice of payment method can significantly impact the overall cost, convenience, and security of purchasing bitcoins.

The most common payment methods accepted by cryptocurrency exchanges include:

- Bank transfer

- Credit/debit card

- Mobile payment

Bank Transfer

Bank transfer is a traditional payment method that involves transferring funds from your bank account to the exchange’s bank account. It is generally considered a secure and reliable method, but it can be slow and may incur additional fees, especially for international transfers.

Credit/Debit Card

Credit/debit cards offer a convenient way to purchase bitcoins, as they are widely accepted and provide instant access to funds. However, they typically come with higher transaction fees compared to other payment methods.

Mobile Payment, Best way to purchase bitcoins

Mobile payment services, such as Apple Pay and Google Pay, allow users to make purchases using their smartphones. They provide a fast and convenient way to buy bitcoins, but may be limited in terms of availability and transaction limits.

Comparison of Payment Methods

| Payment Method | Transaction Fees | Processing Time | Security Considerations |

|---|---|---|---|

| Bank Transfer | Low to moderate | Slow (1-3 business days) | High |

| Credit/Debit Card | High | Instant | Moderate |

| Mobile Payment | Moderate | Fast (within minutes) | Moderate |

The choice of payment method should be based on the individual’s preferences, budget, and security concerns. Bank transfer is a good option for those who prioritize security and low fees, while credit/debit cards offer convenience and instant access to funds.

Mobile payment provides a balance between convenience and security, but may have limitations in terms of availability and transaction limits.

Transaction Fees

When you purchase bitcoins, you will incur transaction fees. These fees are paid to the miners who verify and process your transaction on the blockchain. The amount of the transaction fee will vary depending on the exchange or payment method you use.

The following table compares the transaction fees of different exchanges and payment methods:

| Exchange/Payment Method | Transaction Fee |

|---|---|

| Coinbase (ACH transfer) | $1.49 |

| Coinbase (credit/debit card) | 3.99% |

| Binance (ACH transfer) | $0.50 |

| Binance (credit/debit card) | 4.5% |

| Kraken (ACH transfer) | $0.00 |

| Kraken (credit/debit card) | 3.75% |

As you can see, the transaction fees can vary significantly depending on the exchange or payment method you use. It is important to compare the fees before you make a decision about how to purchase bitcoins.

Impact of Transaction Fees on the Overall Cost of Purchasing Bitcoins

The transaction fees can have a significant impact on the overall cost of purchasing bitcoins. If you are planning to purchase a large amount of bitcoins, the fees can add up quickly. For example, if you are purchasing $1,000 worth of bitcoins and the transaction fee is 3%, you will pay $30 in fees.

It is important to factor in the transaction fees when you are budgeting for your bitcoin purchase. You should also compare the fees of different exchanges and payment methods to find the best deal.

Regulations and Legal Considerations

The regulatory landscape for cryptocurrency varies significantly across different jurisdictions. Some countries have implemented comprehensive regulations, while others have taken a more cautious approach or have yet to establish a clear regulatory framework.

In the United States, cryptocurrency is considered a commodity by the Securities and Exchange Commission (SEC) and is subject to certain regulations under the Securities Act of 1933 and the Securities Exchange Act of 1934. The Commodity Futures Trading Commission (CFTC) also has jurisdiction over cryptocurrency futures and options contracts.

Legal Implications of Purchasing and Owning Bitcoins

The legal implications of purchasing and owning bitcoins vary depending on the jurisdiction in which you reside. In some countries, such as the United States, there are no specific laws that prohibit the purchase or ownership of bitcoins. However, in other countries, such as China, cryptocurrency transactions are illegal.

It is important to be aware of the legal implications of purchasing and owning bitcoins in your jurisdiction before you make any transactions. You should also be aware of the potential risks and challenges associated with cryptocurrency regulation.

Potential Risks and Challenges Associated with Cryptocurrency Regulation

There are a number of potential risks and challenges associated with cryptocurrency regulation. These include:

- Regulatory uncertainty: The regulatory landscape for cryptocurrency is constantly evolving, which can create uncertainty for businesses and investors.

- Increased compliance costs: Cryptocurrency businesses may need to incur significant costs to comply with new regulations.

- Reduced innovation: Overly burdensome regulations could stifle innovation in the cryptocurrency industry.

- Increased risk of fraud and abuse: Cryptocurrency regulations could create new opportunities for fraudsters and other criminals to exploit.

It is important to be aware of these risks and challenges before you invest in cryptocurrency.

Final Thoughts

Navigating the world of bitcoin purchasing can be daunting, but with the right knowledge and strategies, you can confidently enter the cryptocurrency market. This guide has provided you with a comprehensive understanding of the best way to purchase bitcoins, empowering you to make informed decisions and maximize your investment potential.

Remember, the cryptocurrency landscape is constantly evolving, so stay informed and adapt to the changing market dynamics to stay ahead of the curve.

Question & Answer Hub

What factors influence the price of bitcoins?

The price of bitcoins is influenced by various factors, including supply and demand, news events, and market sentiment. Understanding these factors can help you make informed decisions about when to buy or sell bitcoins.

What are the different types of cryptocurrency exchanges?

There are three main types of cryptocurrency exchanges: centralized, decentralized, and peer-to-peer. Each type has its own advantages and disadvantages, so it’s important to choose the exchange that best meets your needs.

What are the security considerations when purchasing bitcoins?

Securing your bitcoins is crucial to protect your investment. Strong passwords, two-factor authentication, and hardware wallets are essential security measures to safeguard your digital assets.