The BTC rate chart is an essential tool for anyone interested in Bitcoin, providing a visual representation of the cryptocurrency’s price movements over time. It offers valuable insights into market conditions, trends, and potential trading opportunities.

This comprehensive guide will delve into the intricacies of the BTC rate chart, exploring its history, current market conditions, technical and fundamental analysis, and comparison to other cryptocurrencies. We will also provide an outlook for Bitcoin’s future price movements, helping you make informed decisions about your investments.

Bitcoin Price History

Bitcoin, the world’s first decentralized digital currency, has experienced significant price fluctuations since its inception in 2009. Its price history is marked by periods of rapid growth, sharp declines, and gradual stabilization.

Bitcoin’s price is influenced by a complex interplay of factors, including market demand and supply, technological developments, regulatory changes, and global economic conditions.

Timeline of Significant Price Movements and Events

- 2009:Bitcoin is created and its initial price is set at $0.0008.

- 2011:Bitcoin reaches its first significant milestone, crossing the $1 mark.

- 2013:Bitcoin experiences a major price surge, reaching a peak of $1,242 before crashing to below $200.

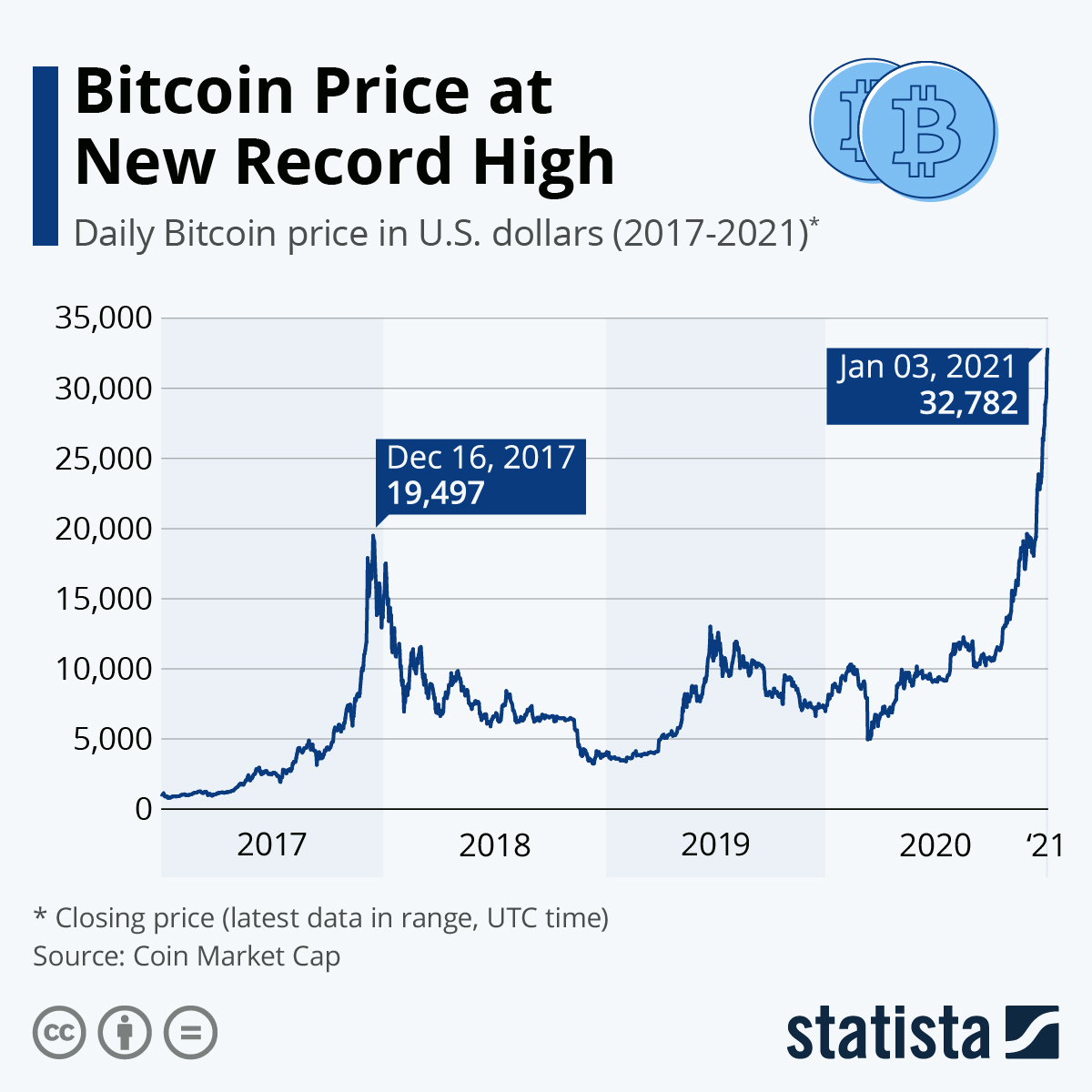

- 2017:Bitcoin enters a bull market, rising from $1,000 to a peak of nearly $20,000 by the end of the year.

- 2018:Bitcoin undergoes a severe price correction, falling to below $3,000.

- 2021:Bitcoin reaches a new all-time high of over $64,000, driven by institutional adoption and increased demand.

- 2022:Bitcoin experiences a prolonged bear market, falling below $20,000.

Factors Influencing Bitcoin’s Price

The following factors have a significant impact on Bitcoin’s price:

- Market Demand and Supply:Bitcoin’s price is primarily determined by the balance between demand for the cryptocurrency and its available supply.

- Technological Developments:Advances in blockchain technology and improvements in Bitcoin’s infrastructure can influence its price.

- Regulatory Changes:Government regulations and policies can have a significant impact on Bitcoin’s price and adoption.

- Global Economic Conditions:Economic uncertainty and macroeconomic factors can affect Bitcoin’s price as investors seek alternative investments or safe havens.

- Media Coverage and Sentiment:Positive or negative media coverage and public sentiment can influence Bitcoin’s price by attracting or deterring investors.

Current Market Conditions

The current Bitcoin market conditions are characterized by high volatility, with prices fluctuating rapidly. The market is influenced by a complex interplay of factors, including macroeconomic conditions, regulatory developments, and investor sentiment.

The recent price action suggests that the market is in a state of flux, with buyers and sellers testing key support and resistance levels. Support refers to the price level at which demand is expected to outweigh supply, preventing further price declines.

Resistance, on the other hand, represents the price level at which supply is expected to exceed demand, leading to a reversal in the upward price trend.

Support and Resistance Levels

The current support level for Bitcoin is around $23,000, while the resistance level is approximately $25,000. If the price falls below the support level, it could indicate a further decline in prices. Conversely, if the price breaks above the resistance level, it could signal a potential bullish trend.

It is important to note that support and resistance levels are not static and can change over time. They are based on historical price data and technical analysis, but they are not guarantees of future price movements.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing the past prices and volume of a security. It is based on the premise that the past performance of a security can be used to predict its future performance.

Technical analysts use a variety of indicators to identify potential trading opportunities. These indicators include:

Moving Averages, Btc rate chart

- Moving averages are a simple way to smooth out price data and identify trends.

- The most common moving averages are the 50-day, 100-day, and 200-day moving averages.

- When the price of a security crosses above a moving average, it is a bullish signal.

- When the price of a security crosses below a moving average, it is a bearish signal.

Fundamental Analysis: Btc Rate Chart

Fundamental analysis involves examining the underlying factors that influence the value of an asset. In the case of Bitcoin, these factors include the supply and demand dynamics, regulations, and adoption.

Supply and demand are the primary drivers of Bitcoin’s price. The supply of Bitcoin is limited by its finite issuance schedule, while the demand for Bitcoin is influenced by factors such as its perceived value as a store of value, medium of exchange, and investment asset.

Regulations

Regulations play a significant role in the price of Bitcoin. Positive regulatory developments, such as the legalization of Bitcoin in certain jurisdictions, can increase demand and drive up prices. Conversely, negative regulatory developments, such as bans or restrictions, can reduce demand and put downward pressure on prices.

Adoption

The adoption of Bitcoin as a legitimate form of payment and investment is another important factor that affects its price. As more businesses and individuals adopt Bitcoin, the demand for the cryptocurrency increases, leading to higher prices.

Comparison to Other Cryptocurrencies

Bitcoin, the world’s most popular cryptocurrency, often serves as a benchmark for the broader cryptocurrency market. By comparing the BTC rate chart to other major cryptocurrencies, we can gain insights into their relative performance and trends, identifying factors that contribute to their differences.

Market Capitalization

- Bitcoin consistently holds the largest market capitalization among cryptocurrencies, followed by Ethereum and Binance Coin.

- Market capitalization is a key indicator of a cryptocurrency’s overall value and market dominance.

Trading Volume

- Bitcoin typically has the highest trading volume compared to other cryptocurrencies.

- High trading volume indicates active market participation and liquidity, making it easier for traders to buy and sell.

Price Volatility

- Bitcoin tends to exhibit higher price volatility than other major cryptocurrencies, such as Ethereum or stablecoins.

- Volatility is influenced by factors like market sentiment, news events, and regulatory changes.

Correlation

- Bitcoin’s price movements often influence the prices of other cryptocurrencies, resulting in a positive correlation.

- However, during market downturns or periods of high volatility, correlations may weaken or even turn negative.

Factors Contributing to Differences

- Network Effects:Bitcoin’s large user base and established network create a strong competitive advantage.

- Institutional Adoption:Bitcoin has gained significant acceptance from institutional investors, further boosting its market presence.

- Regulatory Landscape:Regulatory developments and government stances can impact the performance of cryptocurrencies differently.

Outlook and Predictions

Predicting the future price of Bitcoin is a challenging task, as it is influenced by a multitude of factors. However, by analyzing historical data, current market conditions, and potential future developments, we can provide a general outlook for Bitcoin’s price in the short and long term.

In the short term, Bitcoin’s price is likely to be influenced by factors such as regulatory developments, institutional adoption, and market sentiment. If these factors remain positive, Bitcoin’s price could continue to rise. However, if there are any negative developments, such as a major security breach or a regulatory crackdown, Bitcoin’s price could decline.

Long-Term Outlook

In the long term, Bitcoin’s price is likely to be driven by its underlying fundamentals, such as its scarcity, security, and global acceptance. As Bitcoin becomes more widely adopted as a store of value and a medium of exchange, its price is likely to increase.

However, it is important to note that Bitcoin’s price is highly volatile, and there is no guarantee that it will continue to rise in the future. Investors should always do their own research and invest only what they can afford to lose.

Wrap-Up

In conclusion, the BTC rate chart is a powerful tool that can help investors understand the dynamics of the Bitcoin market. By analyzing price movements, identifying trends, and considering fundamental factors, traders can make informed decisions and potentially profit from Bitcoin’s price fluctuations.

FAQ

What factors influence Bitcoin’s price?

Bitcoin’s price is influenced by a variety of factors, including supply and demand, market sentiment, regulations, and adoption rates.

How can I use technical analysis to identify trading opportunities?

Technical analysis involves studying price charts and patterns to identify potential trading opportunities. By using indicators such as moving averages, support and resistance levels, and candlestick patterns, traders can make informed decisions about when to buy and sell Bitcoin.

What is the difference between technical and fundamental analysis?

Technical analysis focuses on price movements and patterns, while fundamental analysis considers the underlying factors that affect a cryptocurrency’s value, such as supply and demand, adoption rates, and regulations.