Best cryptocurrencies are taking the financial world by storm, and with good reason. They offer a unique combination of decentralization, security, and transparency that is unmatched by traditional financial assets. In this comprehensive guide, we will explore the ins and outs of cryptocurrencies, from their market overview to their investment strategies.

Whether you are a seasoned investor or a curious newcomer, this guide will provide you with everything you need to know about the exciting world of cryptocurrencies.

Market Overview

The cryptocurrency market has experienced significant growth in recent years, with a total market capitalization of over $2 trillion as of 2023. Trading volume has also surged, with daily transactions exceeding billions of dollars. Key trends in the market include the rise of decentralized finance (DeFi), the increasing adoption of cryptocurrencies by institutional investors, and the development of new blockchain technologies.

Factors influencing the performance of cryptocurrencies include economic conditions, regulatory developments, and technological advancements. Economic conditions, such as interest rates and inflation, can impact the demand for cryptocurrencies as an alternative investment. Regulatory developments, such as the introduction of new laws and regulations, can affect the legitimacy and stability of the market.

Technological advancements, such as the development of new blockchain protocols and applications, can drive innovation and adoption.

Market Capitalization

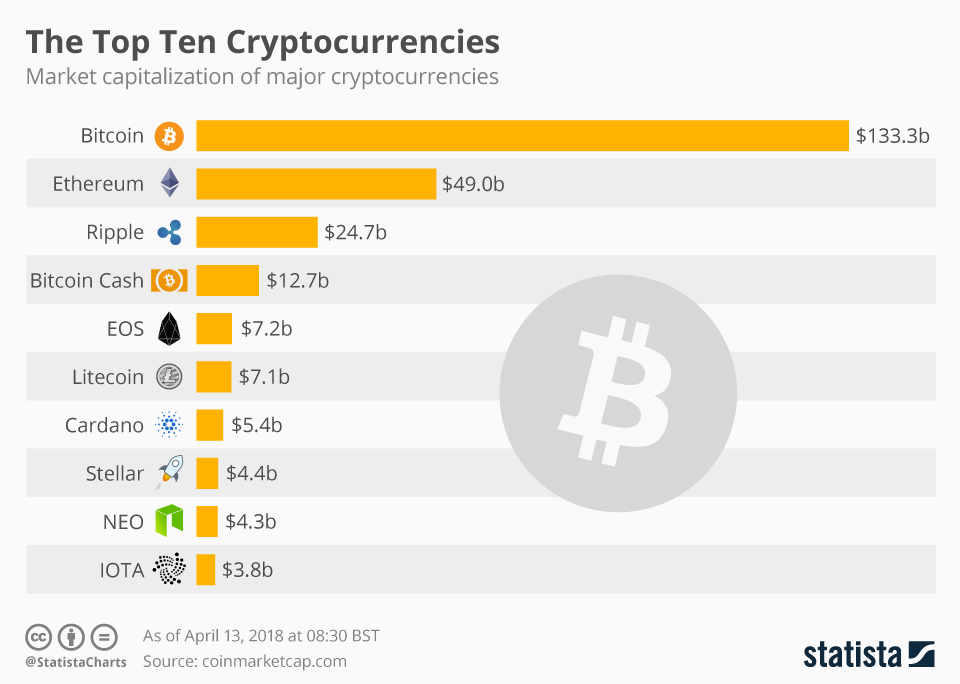

Market capitalization refers to the total value of all outstanding coins or tokens in a cryptocurrency network. It is calculated by multiplying the price of a single coin or token by the total number of coins or tokens in circulation.

Market capitalization is a key indicator of the size and liquidity of a cryptocurrency market.

- Bitcoin has the highest market capitalization, followed by Ethereum and Binance Coin.

- Market capitalization can fluctuate significantly based on supply and demand.

Trading Volume

Trading volume refers to the total amount of cryptocurrency that is bought and sold in a given period of time. It is a measure of the liquidity and activity of a cryptocurrency market. High trading volume indicates that there is a lot of interest in a particular cryptocurrency and that it is easy to buy and sell.

- Trading volume can vary significantly depending on market conditions.

- High trading volume can lead to increased price volatility.

Key Trends

Key trends in the cryptocurrency market include the rise of decentralized finance (DeFi), the increasing adoption of cryptocurrencies by institutional investors, and the development of new blockchain technologies.

- DeFi refers to financial applications that are built on blockchain technology and do not require intermediaries.

- Institutional investors are increasingly allocating a portion of their portfolios to cryptocurrencies.

- New blockchain technologies are being developed to improve scalability, security, and privacy.

Cryptocurrency Characteristics

Cryptocurrencies are digital or virtual assets that use cryptography for security and operate independently of a central bank or government. They possess unique characteristics that distinguish them from traditional financial assets.

Decentralization

Cryptocurrencies are decentralized, meaning they are not controlled by a single entity or organization. Instead, they operate on a distributed network of computers, making them resistant to censorship and manipulation. This decentralized nature ensures that transactions are transparent and verifiable by all participants on the network.

Security

Cryptocurrencies utilize advanced cryptographic techniques to secure transactions and protect against fraud and hacking. The underlying blockchain technology provides an immutable and tamper-proof record of all transactions, making it extremely difficult to alter or counterfeit.

Transparency

All cryptocurrency transactions are recorded on a public ledger, providing transparency and accountability. This allows anyone to view and verify the history of transactions, promoting trust and reducing the risk of fraud.

Immutability

Once a transaction is recorded on the blockchain, it becomes immutable, meaning it cannot be reversed or altered. This immutability ensures the integrity and security of the cryptocurrency system.

Advantages of Cryptocurrencies

- Decentralized and independent of central authorities.

- Secure and protected by cryptography.

- Transparent and verifiable due to public ledger.

- Immutable and tamper-proof transactions.

- Potential for high returns and investment opportunities.

Disadvantages of Cryptocurrencies

- Volatility and price fluctuations.

- Regulatory uncertainty and legal challenges.

- Risk of hacking and cyberattacks.

- Limited acceptance as a form of payment.

- Complexity and technical barriers for some users.

Types of Cryptocurrencies

Cryptocurrencies encompass a diverse range of digital assets with distinct characteristics and use cases. Let’s explore the main types of cryptocurrencies:

Bitcoin

Bitcoin, the pioneer cryptocurrency, is renowned for its decentralized nature, limited supply, and secure blockchain technology. Its primary use case is as a store of value and a medium of exchange.

Ethereum

Ethereum is a decentralized platform that enables the development and execution of smart contracts. Its native cryptocurrency, Ether (ETH), serves as fuel for transactions on the Ethereum network and is widely used in decentralized applications (dApps).

Stablecoins

Stablecoins are cryptocurrencies pegged to the value of fiat currencies like the US dollar or gold. They aim to minimize price volatility, making them suitable for transactions and as a bridge between traditional financial systems and the crypto ecosystem.

Cryptocurrency Exchanges

Cryptocurrency exchanges play a pivotal role in facilitating the buying, selling, and trading of cryptocurrencies. They serve as platforms where individuals can convert fiat currencies into cryptocurrencies and vice versa, as well as trade different cryptocurrencies with each other.

There are two main types of cryptocurrency exchanges: centralized and decentralized.

Centralized Exchanges

Centralized exchanges are operated by a single entity or company that controls the platform and its operations. They typically offer a wide range of cryptocurrencies and trading pairs, as well as advanced trading features such as margin trading and futures contracts.

Some of the most popular centralized exchanges include Binance, Coinbase, and Kraken.

Decentralized Exchanges

Decentralized exchanges (DEXs) are operated on a decentralized network, typically using blockchain technology. They do not have a central authority and instead rely on smart contracts to facilitate trades.

DEXs offer greater anonymity and security compared to centralized exchanges, but they may have limited liquidity and fewer trading options.

Some of the most popular DEXs include Uniswap, PancakeSwap, and SushiSwap.

Cryptocurrency Wallets

Cryptocurrency wallets are digital storage systems that allow users to store, send, and receive cryptocurrencies. They are essential for managing and protecting digital assets, providing security and convenience in the world of cryptocurrencies.Different types of cryptocurrency wallets exist, each with its own set of features and security measures:

Software Wallets

Software wallets are digital applications that store private keys and allow users to manage their cryptocurrencies on computers or mobile devices. They offer convenience and ease of use, but their security depends on the reliability of the software and the device they are installed on.

Hardware Wallets

Hardware wallets are physical devices that store private keys offline, providing enhanced security. They are not connected to the internet, making them less vulnerable to hacking and malware attacks. Hardware wallets are generally more expensive than software wallets but offer a higher level of protection.

Paper Wallets

Paper wallets are physical documents that contain a user’s private and public keys printed on paper. They are considered one of the most secure storage methods as they are not connected to any device or network. However, paper wallets are vulnerable to physical damage or loss.

Cryptocurrency Investment Strategies

Investing in cryptocurrencies can be a lucrative endeavor, but it’s crucial to understand the different investment strategies available to maximize your potential returns. This section explores various cryptocurrency investment strategies, their risks, and potential rewards.

Buy-and-Hold Strategy, Best cryptocurrencies

The buy-and-hold strategy involves purchasing cryptocurrencies and holding them for an extended period, typically years. This strategy is suitable for investors who believe in the long-term potential of cryptocurrencies and are willing to tolerate market volatility. The potential rewards can be substantial if the cryptocurrencies appreciate significantly over time.

Day Trading Strategy

Day trading involves buying and selling cryptocurrencies within a single trading day to capitalize on short-term price fluctuations. This strategy requires a high level of skill and experience, as it involves frequent trading and monitoring market movements. While the potential rewards can be high, the risks are also significant due to the volatility of cryptocurrency prices.

Yield Farming Strategy

Yield farming involves lending cryptocurrencies to earn interest or rewards. This strategy is popular among investors who want to generate passive income from their cryptocurrency holdings. However, it’s important to note that yield farming can be risky, as the interest rates and rewards can fluctuate and are subject to market conditions.

Cryptocurrency Regulation

Cryptocurrency regulation is a complex and evolving landscape, as governments around the world grapple with the challenges and opportunities presented by this new asset class.The regulatory landscape for cryptocurrencies varies significantly from country to country. Some countries, such as the United States and the United Kingdom, have taken a relatively hands-off approach, while others, such as China and South Korea, have implemented strict regulations.There are a number of challenges associated with cryptocurrency regulation.

One challenge is the decentralized nature of cryptocurrencies. Unlike traditional fiat currencies, which are issued and controlled by central banks, cryptocurrencies are decentralized and operate on a peer-to-peer network. This makes it difficult for governments to regulate cryptocurrencies in the same way that they regulate traditional fiat currencies.Another challenge is the global nature of cryptocurrencies.

Cryptocurrencies can be traded anywhere in the world, making it difficult for governments to regulate them on a national level.Despite the challenges, there are also a number of opportunities presented by cryptocurrency regulation. Regulation can provide clarity and certainty for businesses and investors, and it can help to protect consumers from fraud and abuse.

Challenges of Cryptocurrency Regulation

There are a number of challenges associated with cryptocurrency regulation. One challenge is the decentralized nature of cryptocurrencies. Unlike traditional fiat currencies, which are issued and controlled by central banks, cryptocurrencies are decentralized and operate on a peer-to-peer network. This makes it difficult for governments to regulate cryptocurrencies in the same way that they regulate traditional fiat currencies.Another challenge is the global nature of cryptocurrencies.

Cryptocurrencies can be traded anywhere in the world, making it difficult for governments to regulate them on a national level.

Opportunities of Cryptocurrency Regulation

Despite the challenges, there are also a number of opportunities presented by cryptocurrency regulation. Regulation can provide clarity and certainty for businesses and investors, and it can help to protect consumers from fraud and abuse.Regulation can also help to legitimize cryptocurrencies and make them more attractive to mainstream investors.

This could lead to increased investment in cryptocurrencies and the development of new and innovative applications for this technology.

Future of Cryptocurrencies: Best Cryptocurrencies

The future of cryptocurrencies is uncertain, but there are a number of potential technological advancements, regulatory changes, and adoption by mainstream institutions that could shape their future.One of the most significant potential technological advancements is the development of quantum computing.

Quantum computers could be used to break the encryption that is used to secure cryptocurrencies, which could make them vulnerable to theft. However, there are also a number of potential developments that could make cryptocurrencies more secure, such as the development of new encryption algorithms and the use of hardware security modules.Regulatory changes could also have a significant impact on the future of cryptocurrencies.

Governments around the world are still grappling with how to regulate cryptocurrencies, and there is a risk that they could impose regulations that make it difficult or impossible for cryptocurrencies to operate. However, there is also the potential for governments to adopt regulations that make it easier for cryptocurrencies to be used and traded.Adoption by mainstream institutions could also help to shape the future of cryptocurrencies.

If major financial institutions start to adopt cryptocurrencies, it could lead to a wider acceptance of cryptocurrencies and a surge in their value. However, there are also a number of challenges that could prevent cryptocurrencies from being adopted by mainstream institutions, such as their volatility and the lack of regulation.

Challenges and Opportunities

The cryptocurrency industry faces a number of challenges, including:* Volatility: The value of cryptocurrencies can fluctuate wildly, making them a risky investment.

Regulation

Governments around the world are still grappling with how to regulate cryptocurrencies, and there is a risk that they could impose regulations that make it difficult or impossible for cryptocurrencies to operate.

Security

Cryptocurrencies are vulnerable to theft and fraud, and there is a risk that they could be used for illegal activities.However, the cryptocurrency industry also has a number of opportunities, including:* Innovation: Cryptocurrencies are a new and innovative technology, and there is a lot of potential for further development.

Global reach

Cryptocurrencies can be used anywhere in the world, which makes them a convenient way to send and receive money.

Transparency

Cryptocurrencies are based on a blockchain, which is a public ledger that records all transactions. This makes cryptocurrencies more transparent than traditional financial systems.

Last Recap

As the cryptocurrency industry continues to evolve, it is important to stay informed about the latest trends and developments. By understanding the market overview, cryptocurrency characteristics, types of cryptocurrencies, cryptocurrency exchanges, cryptocurrency wallets, cryptocurrency investment strategies, cryptocurrency regulation, and the future of cryptocurrencies, you will be well-equipped to make informed decisions about your cryptocurrency investments.

Essential FAQs

What are the key characteristics of cryptocurrencies?

The key characteristics of cryptocurrencies include decentralization, security, transparency, and immutability.

What are the different types of cryptocurrencies?

There are many different types of cryptocurrencies, including Bitcoin, Ethereum, stablecoins, and altcoins.

How do I invest in cryptocurrencies?

There are many different ways to invest in cryptocurrencies, including buy-and-hold, day trading, and yield farming.

What is the future of cryptocurrencies?

The future of cryptocurrencies is bright, with potential technological advancements, regulatory changes, and adoption by mainstream institutions.