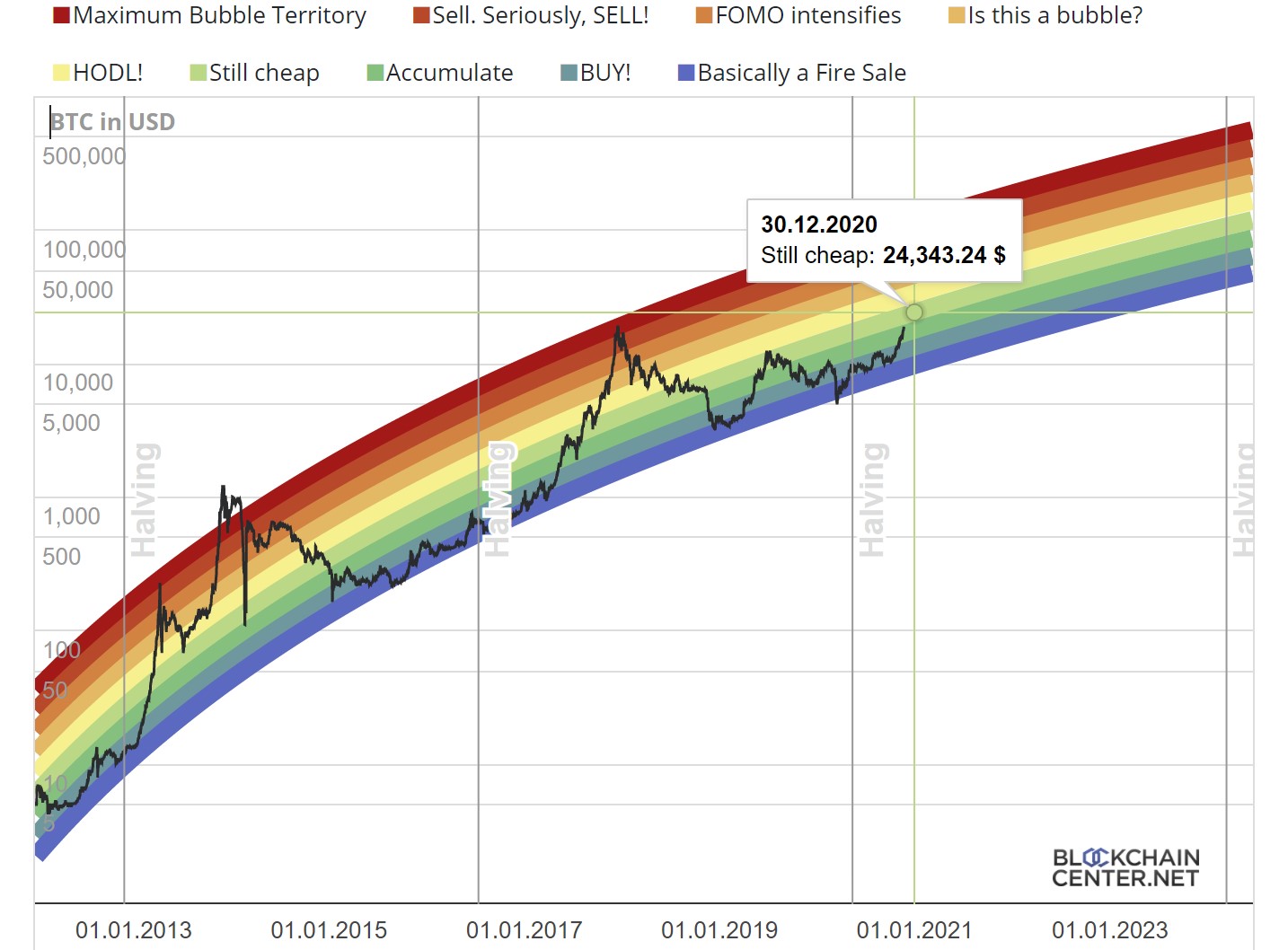

The BTC value graph is a captivating tale of price fluctuations, market dynamics, and technical insights. It paints a vivid picture of the cryptocurrency’s journey, from its humble beginnings to its current status as a global financial phenomenon.

Delving into the BTC value graph, we uncover the factors that drive its value, the relationship between BTC and other markets, and the role of technical analysis in predicting its future trajectory.

Historical Trends: Btc Value Graph

The historical price fluctuations of Bitcoin (BTC) have been characterized by periods of both rapid growth and significant volatility. The cryptocurrency has experienced several major highs and lows, influenced by a combination of market sentiment, technological developments, and external events.

Price Movements

- Early Years (2009-2013):BTC’s early price movements were relatively modest, with the cryptocurrency initially trading below $1. In 2011, it experienced its first significant price spike, rising to over $30 before crashing back down.

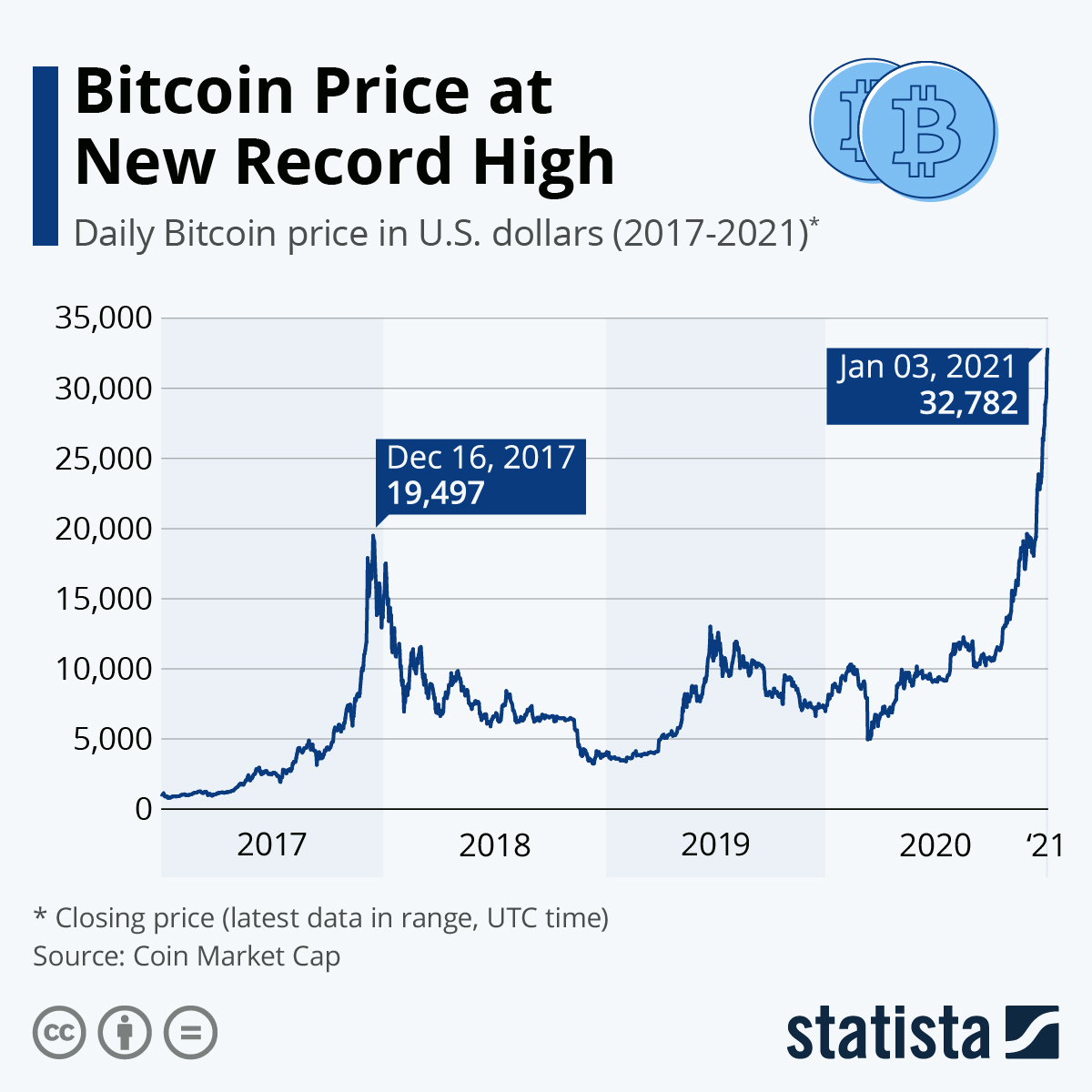

- 2017 Bull Run:In 2017, BTC embarked on a parabolic bull run, driven by increased media attention and retail investor interest. The cryptocurrency reached an all-time high of nearly $20,000 in December 2017.

- 2018-2019 Bear Market:Following the 2017 bull run, BTC entered a prolonged bear market, with its price falling by more than 80%. The cryptocurrency struggled to regain its momentum during this period.

- 2020-2021 Bull Run:In 2020, BTC began another bull run, fueled by institutional investment and the COVID-19 pandemic. The cryptocurrency reached a new all-time high of over $64,000 in April 2021.

- 2022 Bear Market:BTC has experienced a significant decline in price since its 2021 high. The cryptocurrency has been impacted by factors such as rising interest rates, geopolitical uncertainty, and the collapse of several major crypto exchanges.

Influential Events

- Mt. Gox Hack (2014):The hack of the Mt. Gox cryptocurrency exchange resulted in the theft of over 850,000 BTC. This event had a significant impact on BTC’s price, causing it to decline by more than 50%.

- China’s Bitcoin Ban (2017):In 2017, the Chinese government banned initial coin offerings (ICOs) and cryptocurrency exchanges. This ban had a negative impact on BTC’s price, causing it to decline by more than 30%.

- COVID-19 Pandemic (2020):The COVID-19 pandemic led to increased interest in cryptocurrencies as a safe haven asset. This contributed to BTC’s 2020-2021 bull run.

- Ukraine War (2022):The ongoing war in Ukraine has had a mixed impact on BTC’s price. While some investors have viewed BTC as a safe haven asset during times of uncertainty, others have been concerned about the potential impact of the war on the global economy.

Market Dynamics

The value of Bitcoin (BTC) is influenced by a complex interplay of market forces, including supply and demand, market sentiment, and regulatory changes. Understanding these dynamics is crucial for investors seeking to navigate the volatile cryptocurrency market.

Supply and demand play a fundamental role in determining BTC’s value. The limited supply of BTC, capped at 21 million coins, creates scarcity, which can drive up prices when demand is high. On the other hand, increased supply, such as through mining rewards or the release of new BTC from exchanges, can put downward pressure on prices.

Market Sentiment

Market sentiment, often measured through social media sentiment analysis and trading volume, can significantly impact BTC’s value. Positive sentiment, such as optimism about the future of cryptocurrency or anticipation of a major announcement, can lead to increased buying and higher prices.

Conversely, negative sentiment, such as concerns about security breaches or regulatory crackdowns, can trigger sell-offs and lower prices.

Regulatory Changes

Regulatory changes can have a profound impact on BTC’s value. Favorable regulations, such as the adoption of cryptocurrency by major institutions or the introduction of clear regulatory frameworks, can boost investor confidence and drive up prices. Conversely, negative regulations, such as bans on cryptocurrency trading or excessive taxation, can dampen market sentiment and lead to price declines.

Relationship with Other Cryptocurrencies and Traditional Financial Markets

BTC’s value is also influenced by its relationship with other cryptocurrencies and traditional financial markets. As the dominant cryptocurrency, BTC often sets the trend for the broader cryptocurrency market. However, individual cryptocurrencies can experience unique price movements based on their specific use cases and developments.

The relationship between BTC and traditional financial markets is complex and evolving. While BTC has historically been considered an uncorrelated asset, recent market events have shown increased correlation with traditional assets, particularly during periods of economic uncertainty.

Institutional Investment

The entry of institutional investors, such as hedge funds and asset managers, has significantly impacted BTC’s value. Institutional investment brings increased liquidity and stability to the market, as these investors often have long-term investment horizons and can absorb price fluctuations.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing the past performance of prices, trading volume, and other relevant data. Technical analysts use a variety of indicators and tools to identify trends, support and resistance levels, and other patterns that can help them make trading decisions.

Some of the most common technical indicators used in BTC analysis include:

Moving Averages

- Moving averages are a type of technical indicator that shows the average price of a security over a specified period of time. Moving averages can be used to identify trends, support and resistance levels, and other patterns.

Bollinger Bands

- Bollinger Bands are a type of technical indicator that shows the volatility of a security. Bollinger Bands are created by calculating the standard deviation of a security’s price over a specified period of time and then plotting two lines two standard deviations above and below the moving average.

Support and Resistance Levels

- Support and resistance levels are areas on a price chart where the price of a security has difficulty moving above or below. Support levels are areas where the price of a security has found support and bounced back up, while resistance levels are areas where the price of a security has met resistance and fallen back down.

Trend Lines

- Trend lines are lines that connect two or more points on a price chart. Trend lines can be used to identify the direction of a trend and to make predictions about future price movements.

Market Forecasts

Experts and market analysts have varying opinions on the future value of Bitcoin (BTC). Some predict continued growth, while others anticipate corrections or even a decline in value. Various factors, including global economic conditions, regulatory changes, and technological advancements, could influence BTC’s future price trajectory.

Bullish Forecasts

- PlanB’s Stock-to-Flow Model:This model suggests that BTC’s value is driven by its scarcity and predicts a significant price increase in the long term.

- Institutional Adoption:As more institutional investors enter the crypto market, the demand for BTC is expected to increase, potentially driving up its value.

- Growing Acceptance:The increasing acceptance of BTC as a payment method and store of value could contribute to its price appreciation.

Bearish Forecasts

- Regulatory Uncertainty:Stricter regulations or a crackdown on cryptocurrencies could negatively impact BTC’s value.

- Competition from Altcoins:The emergence of alternative cryptocurrencies could divert investors away from BTC, potentially affecting its dominance.

- Economic Downturn:A global economic recession could lead to a decrease in demand for risky assets like BTC.

Table of Market Forecasts, Btc value graph

| Source | Forecast | Rationale |

|---|---|---|

| PlanB | $100,000 by 2025 | Stock-to-flow model |

| JPMorgan | $150,000 by 2030 | Institutional adoption |

| Goldman Sachs | $10,000 by 2023 | Regulatory uncertainty |

Final Conclusion

The BTC value graph is a constantly evolving landscape, shaped by a complex interplay of market forces and technological advancements. By understanding the historical trends, market dynamics, and technical indicators that influence BTC’s price, investors can make informed decisions and navigate the ever-changing cryptocurrency market.

Answers to Common Questions

What factors influence the value of BTC?

BTC’s value is influenced by a combination of factors, including supply and demand, market sentiment, regulatory changes, and the broader macroeconomic environment.

How can technical analysis be used to predict BTC’s price movements?

Technical analysis involves using historical price data and technical indicators to identify patterns and trends that may indicate future price movements. However, it’s important to note that technical analysis is not a foolproof method of prediction.