In the realm of cryptocurrency, where to buy BTC with credit card is a question that sparks curiosity among investors. This guide delves into the world of Bitcoin purchases, exploring reputable platforms, considerations for choosing the right one, and a step-by-step guide to acquiring BTC seamlessly.

Navigating the landscape of BTC purchases with credit cards requires careful consideration. Factors such as fees, security, ease of use, and customer support play a crucial role in selecting a platform that aligns with your needs. Understanding these aspects empowers you to make informed decisions and safeguard your investments.

Platforms for Purchasing BTC with Credit Card

Individuals seeking to purchase Bitcoin (BTC) with credit cards have multiple reputable platforms at their disposal. These platforms offer varying fees, supported credit cards, and security measures, catering to diverse user preferences and requirements.

The following table provides a comprehensive overview of the leading platforms that facilitate BTC purchases using credit cards:

Platform Comparison

| Platform | Fees | Supported Credit Cards | Security Measures |

|---|---|---|---|

| Coinbase | 3.99% | Visa, Mastercard | 2-factor authentication, SSL encryption |

| Binance | 4.5% | Visa, Mastercard, Maestro | 2-factor authentication, cold storage |

| Kraken | 3.75% | Visa, Mastercard, American Express | 2-factor authentication, multi-factor authentication |

| Gemini | 3.5% | Visa, Mastercard | 2-factor authentication, hardware security keys |

| Bitstamp | 5% | Visa, Mastercard | 2-factor authentication, cold storage |

It’s important to note that fees and supported credit cards may vary depending on the platform and the user’s location. Additionally, users should thoroughly research and compare the security measures implemented by each platform before selecting one for their BTC purchases.

Considerations for Choosing a Platform

Selecting the right platform for purchasing BTC with a credit card is crucial. Consider the following factors:

Fees

- Compare transaction fees, including processing fees, network fees, and any additional charges.

- Look for platforms with transparent fee structures and avoid hidden costs.

Security

- Verify the platform’s security measures, such as SSL encryption, two-factor authentication, and cold storage for BTC.

- Check the platform’s track record and reputation for security.

Ease of Use

- Choose a platform with a user-friendly interface and clear instructions.

- Consider the platform’s compatibility with different devices and browsers.

Customer Support

- Ensure the platform provides reliable customer support through multiple channels (e.g., live chat, email, phone).

- Check the platform’s responsiveness and efficiency in resolving queries.

Evaluating Platform Reliability and Trustworthiness

- Research the platform’s history, ownership, and regulatory compliance.

- Read online reviews and testimonials from previous users.

- Check the platform’s social media presence and engagement.

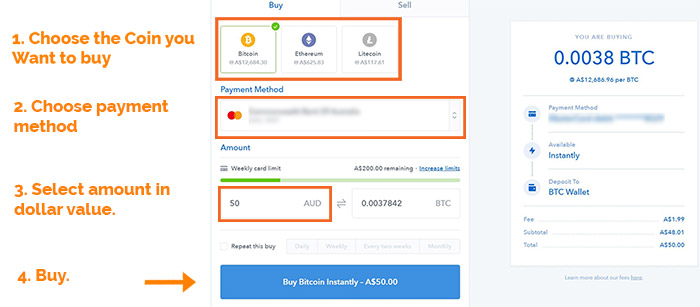

Step-by-Step Guide to Purchasing BTC

Purchasing Bitcoin (BTC) with a credit card is a straightforward process that can be completed in a few simple steps. Follow this guide to learn how to buy BTC with a credit card, including creating an account, verifying your identity, and initiating a purchase.

Creating an Account

- Visit the website of a reputable cryptocurrency exchange that supports credit card purchases.

- Click on the “Sign Up” or “Create Account” button.

- Enter your personal information, including your name, email address, and password.

- Complete the account creation process by following the instructions provided by the exchange.

Verifying Your Identity

Most cryptocurrency exchanges require users to verify their identity before they can purchase BTC with a credit card. This is to comply with anti-money laundering and know-your-customer (KYC) regulations.

- Log in to your account on the cryptocurrency exchange.

- Click on the “Verify Identity” or “KYC” tab.

- Upload a government-issued ID, such as a passport or driver’s license.

- Provide a proof of address, such as a utility bill or bank statement.

- Complete the identity verification process by following the instructions provided by the exchange.

Initiating a Purchase, Where to buy btc with credit card

Once your identity has been verified, you can initiate a BTC purchase with your credit card.

- Log in to your account on the cryptocurrency exchange.

- Click on the “Buy BTC” or “Trade” tab.

- Enter the amount of BTC you want to purchase.

- Select “Credit Card” as the payment method.

- Enter your credit card information and complete the purchase.

Your BTC will be credited to your account on the cryptocurrency exchange within a few minutes.

Potential Risks and Mitigation Strategies

Purchasing BTC with a credit card poses certain risks that should be carefully considered before making a transaction. These risks include fraud, high fees, and market volatility. However, there are strategies that can be implemented to mitigate these risks and ensure a secure and successful transaction.

Fraud

- Use reputable platforms:Choose platforms that have a proven track record of security and customer protection.

- Monitor transactions:Regularly review your credit card statements for unauthorized purchases.

- Enable fraud alerts:Set up fraud alerts with your credit card issuer to receive notifications of suspicious activity.

High Fees

- Compare fees:Research different platforms and compare their fees before making a purchase.

- Use platforms with low fees:Opt for platforms that offer competitive fees to minimize the cost of the transaction.

li> Consider using a crypto exchange:Crypto exchanges typically offer lower fees than other platforms for purchasing BTC with a credit card.

Market Volatility

- Understand market trends:Stay informed about the latest market news and trends to make informed decisions about when to buy BTC.

- Purchase small amounts:Avoid investing large sums of money in BTC at once, especially if you are new to the market.

- Consider dollar-cost averaging:Spread out your purchases over time to reduce the impact of market fluctuations.

Alternatives to Credit Card Purchases

While credit cards offer convenience, they may not be the only option for purchasing BTC. Exploring alternative methods can provide flexibility and cater to specific preferences.

These alternatives include peer-to-peer marketplaces, exchanges, and debit cards, each with its own advantages and drawbacks.

Peer-to-Peer Marketplaces

Peer-to-peer marketplaces facilitate direct transactions between buyers and sellers, eliminating intermediaries. This can often result in lower fees and greater flexibility in payment methods.

- Advantages:Lower fees, anonymity, and direct negotiation with sellers.

- Disadvantages:Potential for scams, limited liquidity, and time-consuming transactions.

Exchanges

Exchanges act as intermediaries, matching buyers and sellers and providing a platform for transactions. They offer a wider selection of cryptocurrencies and may have higher liquidity than peer-to-peer marketplaces.

- Advantages:High liquidity, secure transactions, and access to a variety of cryptocurrencies.

- Disadvantages:Fees can be higher, identity verification is required, and exchanges may be subject to regulation.

Debit Cards

Debit cards linked to crypto wallets allow users to make purchases using their BTC balance. This provides convenience and eliminates the need for conversion fees when spending BTC.

- Advantages:Convenience, no conversion fees, and instant access to BTC for purchases.

- Disadvantages:Fees associated with debit cards, limited acceptance, and potential security risks.

Wrap-Up

Purchasing BTC with a credit card offers convenience, but it’s essential to be aware of potential risks and mitigation strategies. By choosing reputable platforms, monitoring transactions, and staying informed about market trends, you can minimize risks and maximize your BTC acquisition experience.

Whether you’re a seasoned investor or a novice entering the crypto world, this guide provides valuable insights and practical advice to empower your BTC purchases with confidence.

FAQ Overview: Where To Buy Btc With Credit Card

What are the advantages of buying BTC with a credit card?

Convenience and immediate access to BTC are key advantages.

Are there any fees associated with buying BTC with a credit card?

Yes, platforms typically charge fees for processing credit card transactions.

How can I ensure the security of my BTC purchases?

Choose reputable platforms with robust security measures, monitor transactions, and stay updated on market trends.